Importing Data into Simple Invoice Maker

- Download the import template by going to Settings > Import Data and selecting Download CSV Template.

- Open the template in a spreadsheet application (e.g., Microsoft Excel).

-

Populate the CSV file with your data. Below is a list of the available fields. Date fields need to be entered in the following format YYYY-MM-DD. Fields in bold are mandatory — if others don’t apply to you, leave them blank:

- invoice number – a unique number for each invoice

- invoice date – the date of the invoice - YYYY-MM-DD

- due date – the payment due date - YYYY-MM-DD

- sent (Yes/No) – has the invoice been sent?

- paid (Yes/No) – has the invoice been paid?

- paid date – the date it was paid - YYYY-MM-DD

- tax name – e.g. VAT

- tax percentage – just the number, no % symbol (e.g. 20)

- tax inclusive (Yes/No) – is tax included in the price?

- additional tax name – e.g. Sales Tax

- additional tax percentage – just the number, no % symbol (e.g. 5)

- additional tax inclusive (Yes/No)

- discount type – "amount" or "percentage"

- discount amount – if using amount

- discount percentage – if using percentage

- discount after tax (Yes/No)

- shipping amount – amount charged for shipping

- shipping taxable (Yes/No)

- archived (Yes/No)

- customer number – unique customer ID

- customer name

- customer email

- customer phone

- customer address

- customer tax reg number

- item name

- price

- product code

- quantity

- business name

- business address

- business email

- business phone

- business tax reg number

- payment info

- additional info – e.g. "Thanks for your order"

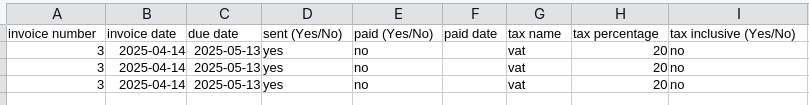

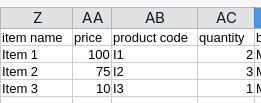

Take the below example, this invoice has 3 items:

Notice how only item fields change across the rows, but all other fields are repeated. When doing this, please ensure all repeated rows are exactly the same to ensure your data imports correctly. If different invoice numbers are used it will create separate invoices in the app; if other fields differ, then this information could fail to import.

To avoid duplicate customers or businesses, keep names and customer numbers consistent throughout the file.

- Finally, once you’ve populated the CSV template, open the app, go to Settings > Import Data, and then press the Upload button under “Upload your data from CSV”.